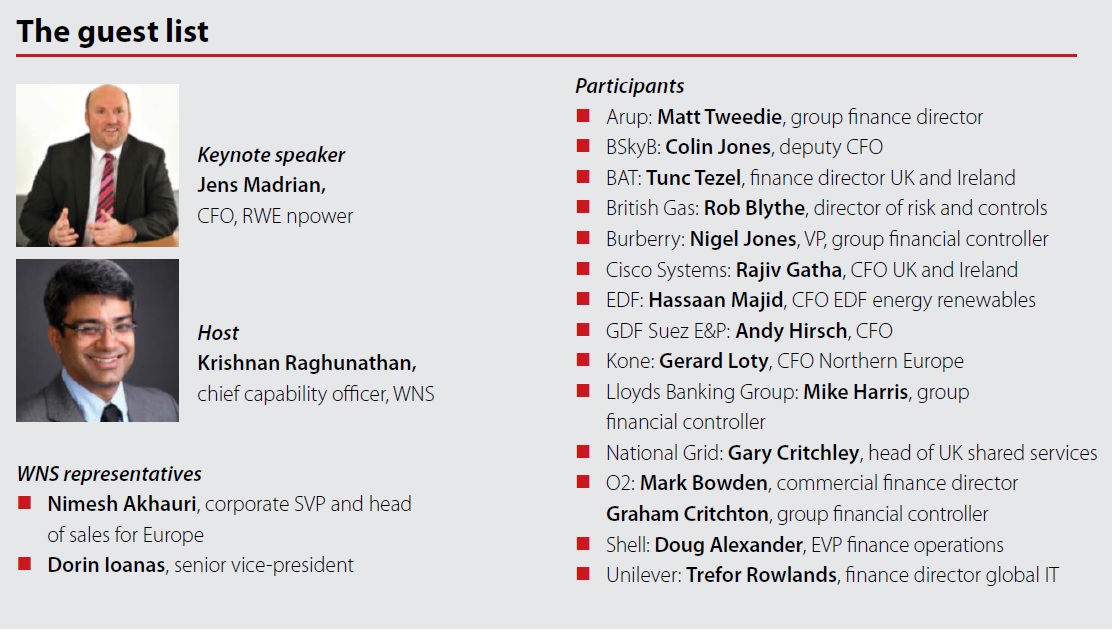

FDE’s summer briefing, produced in association with WNS, focused on the future of global business – specifically the finance function. According to keynote speaker Jens Madrian, CFO, RWE npower, as time passes and the world becomes increasingly digital, the F in CFO will increasingly stand for ‘future’.

We live in a hyper-connected world characterised by a single constant – disruptive change. Technologies such as mobile, IoT, cloud, advanced robotics and artificial intelligence are transforming lives and the way business is conducted. Thriving in this fast-paced, unforgiving environment requires financial leaders to ‘future-proof’ their businesses. This casts the CFO in the undisputed role of the chief future officer. To fulfil this role effectively, CFOs will need to be strategic leaders and leverage timely, accurate and actionable insights to help steer their company to a strong future. It is against this backdrop that FDE’s Q2 London Round table, organised in association with WNS, focused on the topic ‘The Chief Future Officer – What’s your 2020 vision?’ It gave attendees, who were CFOs or heads of operational finance from successful companies across Europe, a chance to discuss the stewardship necessary to navigate companies in this digital era. It also set the context on how a CFO’s role has evolved and the ways in which they can transform the finance function, drive innovation, and leverage analytics while mitigating risks from digitisation. In essence, the CFO’s VISION 2020 encompasses driving strategy, innovation and transformation, firmly in the saddle of the chief future officer.

The Chief Future Officer - What’s your 2020 vision?

The FDE event keynote speaker Jens Madrian, CFO RWE npower, began by discussing the importance of ‘digitisation’ – how it simplifies processes, improves communication and enhances customer engagement. In his view, digitisation is not just about cost reduction, it is also about improving agility in the front and back office. He then went on to emphasise the need for CFOs to become true business partners. “Personally, I focus a good part of my time helping the business to drive cost efficiencies and top-line growth – next to ensuring financial governance and controls to protect the company’s assets. It’s not an either or – if you lose out on any one of them, you will simply not be able to drive sustainable business performance,” he says. Moreover, a CFO’s role has not changed. He still has to run the compliance and governance aspects but they also need to understand the business and its consumers. Host Krishnan Raghunathan, chief capability officer, WNS, added, “How do you define CFO as a business partner? Is the scope restricted to performance-monitoring, future investments, which they already have done? How can a CFO become a business partner and harness digitisation to drive business growth? This is a central topic for organizations that are looking at the CFO to drive capability and innovation.”

In this evolving era of changing technology and consumerism, the CFO’s role has evolved from the traditional one of overseeing finance and compliance to priming the organisation for growth and innovation. Globally, CFOs are wondering how they should leverage analytics and technology, and develop talent to meet future demands. When developing growth strategies, CFOs need to explore all opportunities, including the right skills, people and technology to deliver superior customer experience. Globalisation and changing consumerism has necessitated the need to improve efficiency and service delivery.

Changing value delivery and driving future growth: how can CFOs focus on the digital transformation of business processes?

CFOs have always performed the traditional functions of finance and accounting; however, the new era demands agility and nimbleness. The modern, more forward-looking CFO also needs to standardise processes, integrate front and back office, manage talent, and eliminate silos to enable the firms to respond faster to markets and customers. The core discussion at the London round table was on improving customer engagement through digitisation. Madrian cited various examples of how RWE npower tried digitising its processes to provide seamless, convenient services to customers. Digital is not just another sales channel, it is a different way of working and will culturally change the way we run our business. Tunc Tezel, finance director UK & reland, British American Tobacco, also discussed how his company was trying to leverage technology to expand customer reach, in the changing tobacco industry landscape. Other answers were also revealing in that, almost all the executives were looking at improving customer engagement and organisational efficiency across offices, through technology.

“Omni-presence of technology is not just about cost reduction. It is about the opportunities we can explore such as hiring the right team, deploying the right technology and skills, sourcing of talent and goods globally, and cutting down the carbon footprint,” - Krishnan Raghunathan, CCO, WNS

"How can an organisation achieve higher customer engagement and improve operational efficiency?"

Many of the leaders present discussed how their companies had implemented ERP across their global offices to integrate processes, enhance transparency and improve data access. Most of them were also looking at automating individual processes to develop lean and flexible operational processes. With a large percentage of bandwidth currently being used on transaction processing, leveraging RPA (robotic process automation) and artificial intelligence can help reduce effort and free up bandwidth for value-added analytical activities. Krishnan Raghunathan discussed the effectiveness of this. “RPA is very capable of mimicking the human behaviour of logging into various systems, collating data from these systems and running a rule-based process.” However, he did highlight the limitations of RPA, including the fact that it does not transform the business processes, rather only improves them. Globally, organisations would need to harness RPA with greater understanding and talent to reap its potential benefits.

“We need to focus on strategy and foster innovation to drive value growth and sustainable business performance,” - Jens Madrian, CFO RWE npower

CFOs: translating global growth ambitions into reality

A CFO in the globalised world we live in is like the captain of a ship. They have to ensure that the company’s overall supply chain, financial and technology operations are optimised to support value growth. The potent combination of globalisation and technology can result in high risk; one of the leaders cited the example of the utility industry. He discussed how CFOs in this industry need to change their attitudes and become less conservative in handling risks, especially in a fast changing environment. The leaders at the event also discussed how digitisation enabled them to create a centralised tructure and standardise processes across all businesses and offices. It improved data access and ensured business continuity for their businesses in the age of digital disruption.

Using data for visionary outcomes: understanding business risks and overcoming them in real time

One of the four themes at the event revolved around analytics and how it can help CFOs drive strategic decision-making. Analytics is being cited as the key to understanding consumer behaviour, reducing redundancies, enabling finance decisions such as M&A and technology investments. Are all CFOs able to realise the benefits of analytics or effectively use the data to manage talent, process, and technology constraint? “How to get access to the information 24/7, anywhere in the world, at your desired bandwidth? How do you train people to store/ protect the information right away and what processes do you use to save costs?” asks Andy Hirsch, CFO, GDF Suez E&P. CFOs also cited the lack of standardisation, automation and a common data repository in using data.

“The choice between having all insights and insights that truly drive action is becoming critical,” - Krishnan Raghunathan, CCO, WNS

Some of the finance leaders discussed how automation, customisation and integration of data from various streams across a single dashboard enabled them to develop better insights. WNS’ Krishnan Raghunathan also talked about the benefits of leveraging non-financial data, and how it can help develop actionable insights that can, therefore, drive strategic investments and growth. Does having an analytical tool ensure actionable insights? Most of the leaders at the event negated it. Having an analytical tool does help standardise the analysis process but it does not ensure actionable insights. To be able to drive value from the data, it is essential that the organisation has the requisite people capability in place.

“Robotics and analytics, the mark is going to move that way,” - Gary Critchley, head of UK Shared Services, National Grid

Shaping the future: cultivating a winning mindset in the digital age

CFOs today clearly understand that they have to evolve as business partners and be ready to lead the change in the future. They need to understand their business needs, and how technology and analytics can drive finance operations. Madrian, for one, believes that rather than changing radically, the CFO role will evolve and grow. “My job is to drive sustainable business performance. Our business will be based on a digital future, so for me not to fully understand how to turn our digital strategy into operational reality would make it impossible to do my job well.” In essence, CFOs playing the role of chief future officers will need to ensure three things: stay nimble to adapt to changes quickly, stay connected with customers and leaders that they work with and help them outperform, and study patterns and trends to invest in the right opportunities that are likely to pay big dividends in the future.

“M&A decisions are not about forensics and targets, its about business and future trends of the industry. Its about analysis around these elements,” - Krishnan Raghunathan, CCO, WNS

Summary

The FDE London Round table highlighted the fact that over the past few decades, the CFO’s role has evolved from a numbercruncher to a strategic thinker. Today, CFOs have a seat along with the CEO and the board for defining and developing the overall strategy of the organisation. They need to provide insights and analysis to support key business decisions, proactively lead strategic initiatives, create efficient finance functions and drive profitable growth. With this broader mandate, CFOs need to rely on analytics and digitisation to focus on where the business is headed rather than using data to discuss the past. The traditional art of decision-making is giving way to a more data-driven, scientific decision-making in pursuit of profitable growth.