WePower, a Lithuania-based startup, is on a mission. It wants to make renewable energy accessible to everyone. To achieve this goal, the company offers a ‘blockchain-based green energy trading platform’ that connects renewable energy producers directly with investors. Producers use the platform to raise capital for their energy projects with a commitment to offer low-cost clean power.

Buyers make investments in these projects using cryptocurrencies through Initial Coin Offerings (ICOs) launched by WePower. Recently, the company raised USD 40 Million – the largest ICO ever in the energy space.1

Another startup, the Germany-based Entrade, converts trash (among other sources of renewable energy) into usable power. Their 40-feet containers (that can be placed in any location) act as mini-power plants that gasify trash, which is then burned in an engine to create electricity.

Both WePower and Entrade represent the changing face of the Energy and Utilities (E&U) industry. Driven by technological, regulatory and competitive forces, E&U companies – traditional providers and startups – are gearing up to economize and gain customer confidence through innovation, technology transformation and resilience.

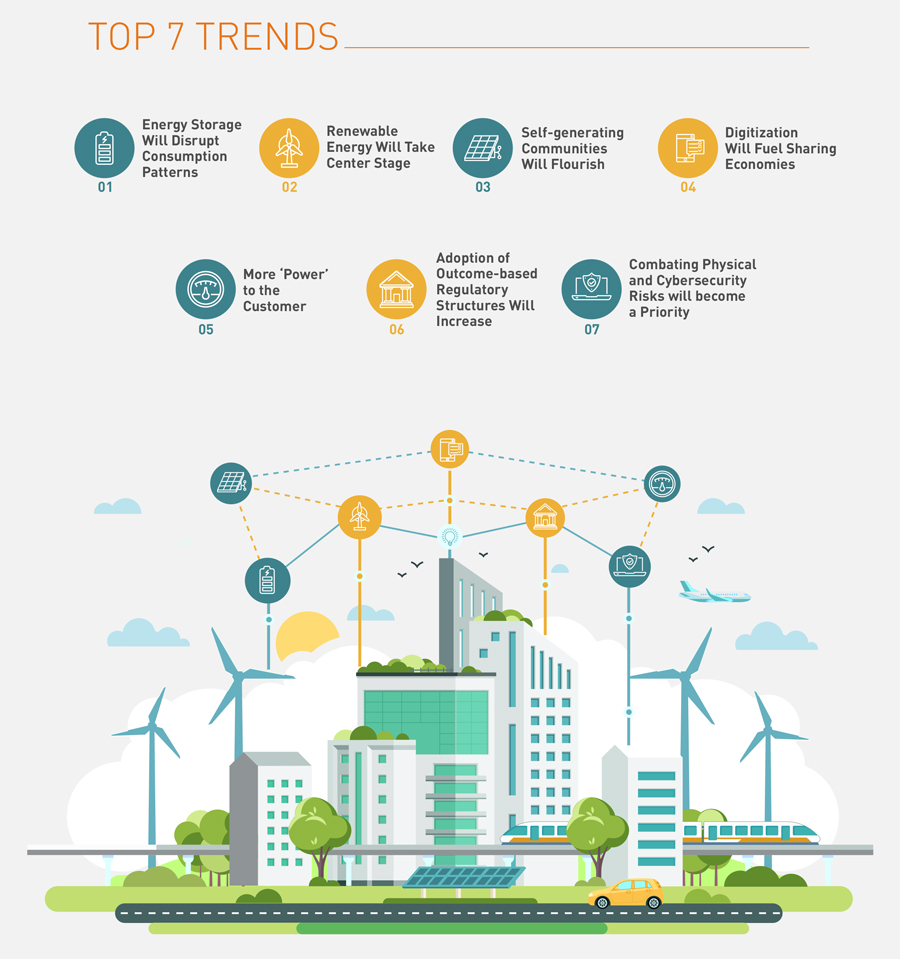

The evolving trends are already visible in the form of smarter grids, greener and cleaner sources of energy, greater customer choices and the resultant empowerment. Here are the key trends that will shape the E&U industry.

1. Energy Storage Will Disrupt Consumption Patterns

1. Energy Storage Will Disrupt Consumption Patterns

The E&U industry’s outlook toward energy production has changed due to the falling prices of batteries. Coupled with Distributed Energy Resources (DERs), energy storage is all set to provide consistent energy flow at lower prices, unfettered by the pulls and pushes of power demands.

Low-cost energy storage will bring down the demand for coal and natural gas, and boost renewable energy production. It will set the tone for innovative storage solutions and use of smart energy devices. Supply and demand for energy will be delinked. This will free E&U companies from the need to build capacity for peak-hour demands and focus instead on the sources of lowest-cost energy generation.

Tesla is now in the run to become a major player in energy storage. The company has stated that it has around 11,000 energy storage projects currently underway in Puerto Rico alone.2

Earlier this year, AES Corporation joined hands with Siemens to form a new energy storage company called Fluence.3 The company will offer customers energy storage applications such as microgrids and islands, renewable integration and energy cost control.

2. Renewable Energy Will Take Center Stage

2. Renewable Energy Will Take Center Stage

Renewable energy technologies and companies have already set the disruptive ball rolling in the E&U industry. In their bid to remain competitive and relevant, traditional E&U companies will increase their investments in renewable energy.

The MidAmerican Energy Company has set a goal to provide 100 percent renewable energy to its customers.4 In 2004, 70 percent of the company’s generation capacity was coal-based. Today, wind comprises over 40 percent of the generation capacity, while coal’s share has fallen to less than 30 percent.

Companies such as Google, Amazon, Apple and Walmart will up the competitive ante by setting up their own solar and wind farms. The reasons to do so are many – going green, cost savings and greater control over energy requirements, to name a few.

These companies will eventually emerge as alternative energy suppliers that will tap into the rapidly growing clean energy market. From large companies to start-ups, these ‘go green’ champions are set to disrupt the energy generation mix and ownership to reimagine the energy market.

3. Self-generating Communities Will Flourish

3. Self-generating Communities Will Flourish

With renewable energy options turning more affordable, the adoption of community-owned renewable generation and storage will rise. Such communities can range from physical ones (cities, towns and campuses) to virtual communities, where peer-to-peer groups trade and share energy assets.

Sonnen Energy in Germany enables residents using solar energy to form communities and sell surplus energy to each other. Nottingham City Council’s non-profit supplier of renewable energy — RobinHoodenergy, provides residents power at the lowest cost possible to tackle 'energy poverty.'5

With the rise of new-age companies with creative offerings, will traditional providers face a decline in revenues? No, if they are innovative in addressing this trend. They can turn this challenge into an opportunity to create new business models of partnership. The partnership between Germany’s largest utility E.ON and Google to expand the former’s solar energy business is a good example of this model.6

4. Digitization Will Fuel Sharing Economies

4. Digitization Will Fuel Sharing Economies

Digital technologies will transform E&U operations across the value chain. Energy generation will be redefined by the use of decentralized networks of intelligent, agile and self-serve units to ramp up, balance and diagnose demand.

Intelligent automation using Internet of Things (IoT), Artificial Intelligence (AI) and Robotic Process Automation (RPA) will increase the efficiencies for demand responsiveness and optimize costs. Customer self-service will see an upswing with the use of mobile apps. Analytical insights will be leveraged to improve customer service and relationships - an area with great scope for improvement for E&U companies.

Digitization will also allow electricity asset owners, prosumers and customers to price and trade energy in decentralized markets based on market value. Blockchain and smart contracts will bring in transparency and trust in the distribution process.

5. More ‘Power’ to the Customer

5. More ‘Power’ to the Customer

According to MarketsandMarkets, the smart home market (driven by smart meters), will be worth USD 138 Billion by 2023.7 This will empower customers to monitor real-time energy consumption and manage energy costs with single-switching systems between home devices.

The empowered customer base will demand redefined business models to address the heightened customer calls for flexibility. HomeServe is a digital service company that provides energy services to more than 7.8 million homes in the U.K. and 3 million homes in the U.S. through a monthly digital subscription model. It does not own any energy assets, but uses third-party suppliers to provide strong customer service and simple payment models.

Octopus, U.K.’s largest investor in solar farms, offers 100 percent renewable electricity and simple pricing without locked-in contracts. The company has leveraged technology to create a leaner business model that places greater control in the hands of the customer.

6. Adoption of Outcome-based Regulatory Structures Will Increase

6. Adoption of Outcome-based Regulatory Structures Will Increase

In the U.S., regulators are leaning toward Performance Based Regulatory (PBR) structures over ‘cost of service’ models. Their aim is to incentivize operational and technical innovations that integrate safety, environment, reliability, social obligations and customer satisfaction.

This approach will also transform customers’ roles from being mere ‘rate-payers’ to powerful entities with more say in the energy transaction. In fact, 13 states in the U.S. are already actively adopting the PBR model.

Innovation, aided by digital transformation, will become critical to integrate data sets across legacy applications, use analytical frameworks and automate processes to drive such outcomes.

7. Combating Physical and Cybersecurity Risks will become a Priority

7. Combating Physical and Cybersecurity Risks will become a Priority

As the proliferation of decentralized and interconnected smart energy assets create greater vulnerability to malevolent security breaches, the E&U industry and government agencies will step up to predict and prevent such risks.

Proactive risk assessments and cybersecurity programs, and sharing of intelligence will intensify to prevent cyber and physical attacks on grids. This will include:

-

Recruiting hackers to proactively predict and manage cyberattacks

-

Architecting end-to-end enterprise-wide detection and response systems

-

Creating effective data and access prioritization

-

Increasing the use of blockchain technology

The U.S. Department of Energy has already set up an office with USD 96 Million in funding to protect the nation’s power grid and other infrastructure against cyberattacks and natural disasters.8 The U.K. has created the National Cybersecurity Centre (NCSC) with the key responsibilities of developing cybersecurity policies and responding to emerging threats. Network and Information Security (NIS), an EU piece of legislation, will be an integral part of the U.K. government’s GBP 1.9 Billion national cybersecurity strategy.9

In the near future, the E&U industry will focus on finding the sweet spot that integrates customer demands for higher flexibility, better cost control and innovative models of services. Creative ‘energy-as-a-service’ business models will facilitate energy efficiency and reduce the cost of best practices in energy management for all types of users.