The ability of organizations to thrive will depend on their ability to automate processes and activities and, in turn, to focus more closely on providing analytical value from the numbers, rather than simply creating them and attesting to the fact that they are correct. More and more, each time a spreadsheet is launched and a finance-function core process is manually adjusted, it takes with it time, money, efficiency, and the opportunity for the finance function to be a higher- value contributor to the business.

Maintaining a competitive advantage requires a forward- looking, virtually real-time understanding of changing conditions and markets. In order to develop that type of understanding, processes and activities must be automated to the extent possible, replacing the speed of the human hand (and the errors it inevitably introduces) with the speed of leading technology. In finance, that means core processes, back-office functions, and other activities must be streamlined to remove the encumbrances that may be holding them back.

All ‘Digital CFOs’ are increasingly expected to be at the center of the future-readiness of their organizations (not just the finance function), preparing their firms for the market demands of the future. So developing a fact-based understanding of the finance function’s capabilities in automation of finance processes and activities is essential to helping these CFOs manage their worlds.

CFOs Rank Their Levels of Automation

How can technology capabilities help finance functions fulfill their new mandate? To explore this question, CFO Research, in collaboration with the business process management firm WNS, surveyed senior finance executives at U.S. companies with more than USD 1 Billion in annual revenues. Based on more than 150 responses, CFO Research developed ratings for the current and future states of the automation of finance processes and activities.

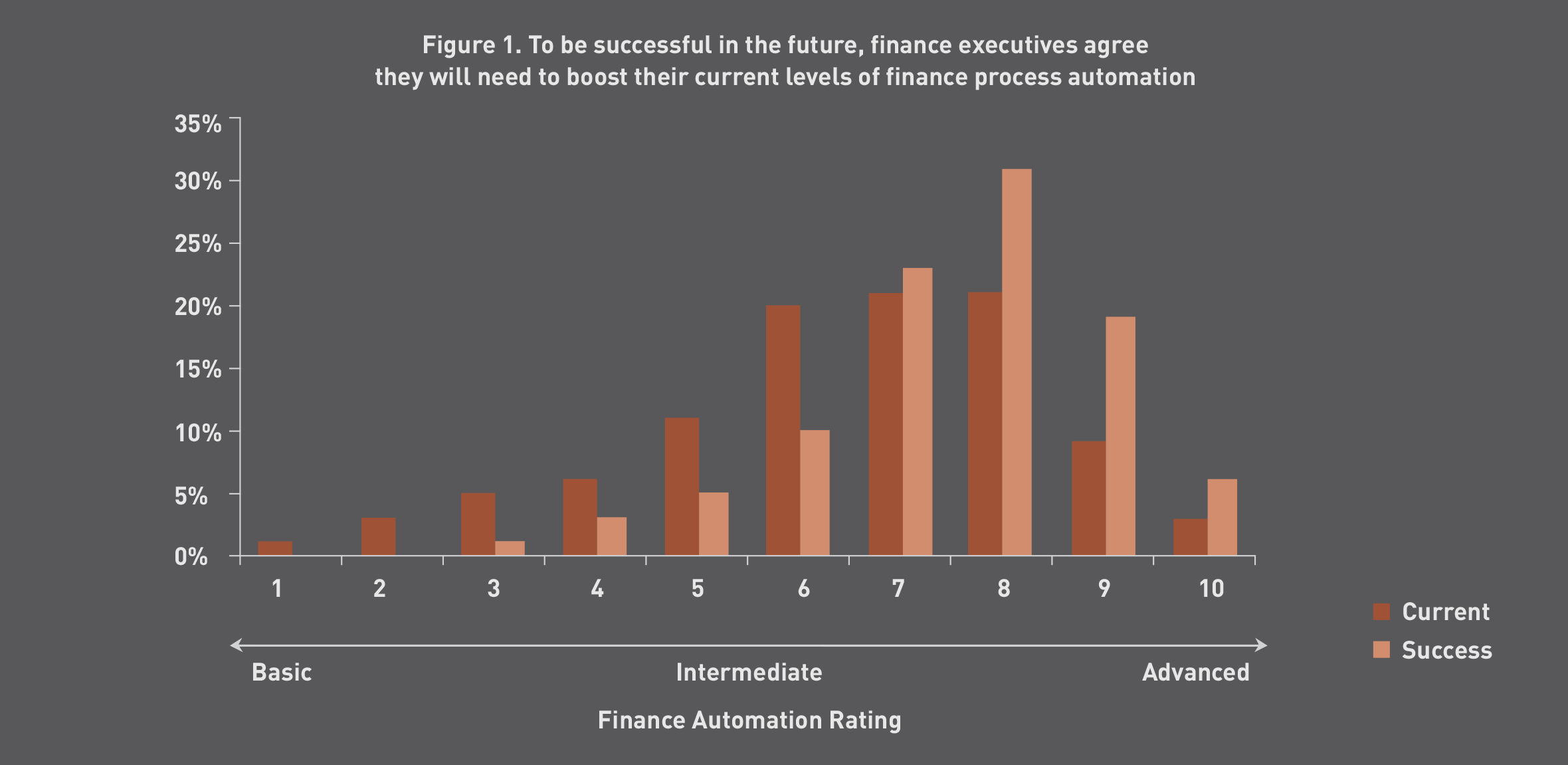

The survey provided finance executives with definitions of basic, intermediate, and advanced levels of automation of finance processes and activities (see ‘Definitions’), and then asked the respondents to rate the current state of their organizations, as well as the level they thought they needed to achieve in two years’ time. It also asked about the benefits executives saw in having advanced capabilities, and the obstacles their companies faced in progressing toward an advanced state.

Definitions: Basic, Intermediate, and Advanced Automation of Finance Processes and Activities

Basic (1 – 3): Most data rekeyed and entered manually

Intermediate (4 – 7): Some types of data entered manually, and some generated by technology tools

Advanced (8 – 10): Most data generated by technology tools, with little need for manual intervention

Automation of Finance Processes and Activities

Finance executives view automation—using technology tools rather than manual data entry—as an important enabler for finance processes and activities. Advanced automation allows most data to be generated by digital tools, with little need for manual intervention. This reduces costs by streamlining processes and improving performance – achieved by reducing the number of manually introduced errors and providing more sophisticated management decision-support tools.

Nearly six in ten survey respondents (57 percent) believe that, in order for their companies to succeed, they will have to achieve an advanced level of automation for managing financial, process, and performance data within the next two years. Unfortunately, there is a lot of progress to be made—only one-third of respondents (34 percent) say that their companies are already at an advanced level in terms of automation.

(See Figure 1)

Potential Benefits

Finance executives recognize that the value from automating finance processes derives from an enhanced ability to manage performance, along with better control over transaction costs. On the one hand, automation lowers the cost of finance by speeding up transaction processing and reducing the number of errors. On the other hand, automated processes also allow more data to be collected more efficiently and organized in ways that provide management with better decision- making tools.

When asked to consider the potential benefits from achieving advanced automation capabilities, respondents identified two benefits as the most important: (1) Realizing efficiency gains in transactional processes such as order-to-cash, purchase-to-pay, record-to-report, and cash management; and (2) Adopting digital performance management tools (e.g., dashboards and visualization; customized management cockpits for planning, budgeting, and forecasting; profitability and cost management). Each of these was placed in among the top three benefits by nearly half of the respondents (48 percent each).

In addition, nearly as many respondents (45 percent) prioritize improvements in their companies’ ability to handle both structured and unstructured data (‘big data’), in order to transform that data quickly into essential business insights. And as big data gets bigger evermore, advanced capabilities in automation of financial processes will need to be rolled out to manage the flow, as well as to ensure that the CFO’s digital performance management tools are updated quickly and accurately.

Reducing Complexity

For many respondents, one stop along the logical path to realizing these benefits will be requiring the organization, as one respondent writes, to reduce complexity in its various forms. “Standardize processes and systems,” he says. Another respondent adds - “Get rid of your homegrown systems.”

A classic path to reducing complexity is to adopt a Shared Services Center / Business Services Center (SSC / BSC) model. A majority of survey respondents believe that within two years’ time, their finance services will be delivered through some form of SSC / BSC, which are typically organized by process or location.

22 percent will ‘mix and match,’ either by using hybrid models (16 percent) that employ both outsourced and in-house resources or by matching delivery models with individual F&A processes to optimize effectiveness (6 percent).

Another 14 percent of respondents expect their finance functions will continue to be decentralized and operate with multiple, in-location finance organizations.

Advanced capabilities in automation of finance processes and activities are a key enabling factor in transitioning to an SSC / BSC model. Without these capabilities, the SSC / BSC partner will be at a loss to understand the key finance function tasks they are expected to support, and will also lack confidence in the data and tools they are using to support the finance team - which must be comprehensive and correct.

Clearly, finance leaders at large companies expect that their ability to leverage the SSC / BSC model will benefit greatly from the reduced organizational and process complexity that is derived from automation of finance processes and activities.

Following a ‘Hands- free’ Path to the Future Organization

The finance executives responding to the survey agree that their functions—as one respondent writes in the survey—need to “get with the times.” Or rather, they see the need to get ahead of the times, and start to transform their organizations now.

To do so, finance will need to reduce complexity in processes, organizations, and information systems. One of the first steps on this journey, according to a number of respondents, is to gain executive management’s commitment to culture change throughout the enterprise. They will also require investment in organizational and process change—for example, investment in an expanded use of SSCs / BSCs, in technology upgrades, and in training and retraining of finance staff.

In the end, finance leaders find themselves considering the best ways to formulate and communicate a clear vision for a future state, in order to gain commitment to change. The CFO Research survey highlights the need to move away from simply benchmarking past performance and move toward helping a finance function meet future demands.

Sponsor's Perspective

The primary benefit of digital transformation is seen when a decrease in operational costs is observed as against an increase in operational efficiency. The CFOs today have realized this need to invest a substantial portion of their capital, in digitizing their finance operations. 50 percent of the respondents expect to spend 1-5 percent of their Cost of Finance Function (COFF) on digitization and automation, and also plan on further increasing such investment in the near future.

WNS as a global provider of Business Process Management (BPM) services has been collaborating with 85+global CFO’s offices in their endeavor to achieve strategic objectives. WNS constantly caters to the growing need of automation by helping apply more resources, talent and investment, develop the ROI and get the leadership commitment to drive change. Learn more about WNS’ advanced technology suite enabling the CFO’s futuristic agenda.

To read the entire report, click here.