Organizations that use knowledge to drive business decisions within all functions and at all levels achieve knowledge centricity which enables highly sustainable competitive advantage. The concept that knowledge is king becomes ingrained in the culture, the CEO's vision, and in every aspect of the company's business. But the goal of besting peer companies by competing with knowledge is an elusive struggle for many organizations.

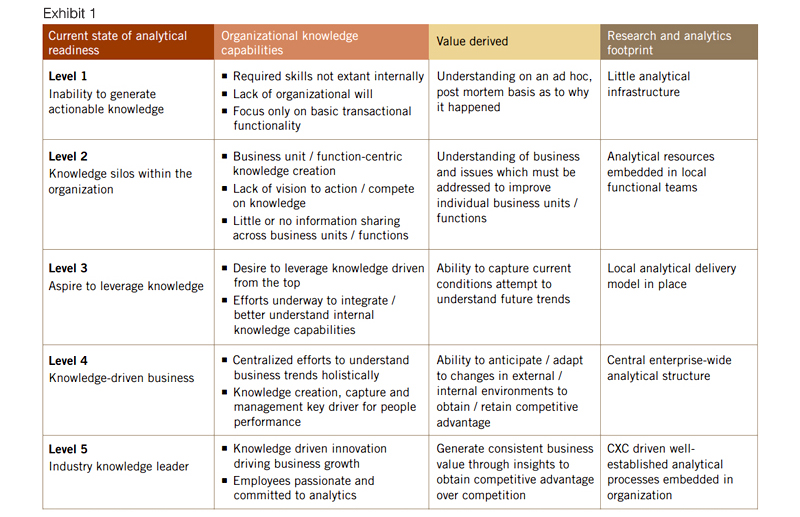

According to research conducted by Harvard University management professor Thomas H. Davenport and consultant Jeanne G. Harris, the first step in becoming a knowledge competitor is assessing the current state of knowledge processes within the organization. Their research indicates that companies typically follow a continuum of development as illustrated in the following exhibit.

The Five Levels Of Knowledge Centricity

The continuum suggests that the journey toward becoming a knowledge competitor involves the levels in which a company evolves on a variety of fronts. Initially, in Level 1, the challenge is a fundamental one - while there may be a desire to become more analytical, the company finds it has neither the resources nor the skills to embark on the journey. To compare, Level 2 companies find that over time they have developed some knowledge capabilities in pockets within their organization, typically in areas in which not having quantitative skills is simply not an option.

Achieving Level 3 is an important watershed for an organization as it reflects a situation in which executives have realized that, in order for their company to keep up with the competition, they must become more quantitative in their decision making. This realization is typically arrived at when a company's competitors consistently generate higher returns, launch better products and gain market share. Level 4 can be considered an incremental step from Level 3. Most importantly, it demonstrates to the organization that the aspirations of Level 3 can be converted into tangible results.

But to fully leverage knowledge for competitive advantage, organizations must grab the Level 5 brass ring whereby knowledge is collaboratively created and consumed across the enterprise, in every department, at every level. This requires adopting a 360° approach in which meetings and business discussions are peppered with facts and analytic investigations, which leads to making knowledge an intrinsic feature of nearly all material strategic and tactical decisions made by the organization.

Where does your organization fall on the path to becoming a knowledge competitor?

The stage-by-stage evolution depicted in Exhibit 1, emphasizes how knowledge creation and its importance are viewed and deployed by an organization. But equally as important are the ‘how’ and ‘what’ of the knowledge created. Only companies that truly believe in the benefits of knowledge and insight creation go the extra mile, taking the time to think through organizational design changes as a catalyst to the knowledge creation process and making investments to ensure the knowledge created is complete and rich in insight.

But even those organizations committed to doing so find embedding knowledge into business processes easier said than done. Let's look briefly at some of the most common challenges.

Skill Set Challenges

Delivery of knowledge processes requires specialized skill sets to generate actionable insights, but knowledge process professionals' skill sets are generally sub-optimal. And even when well-educated, domain-rich knowledge process employees are present in the business, they are often incapable of delivering the full range of analytical processes. As a result, most companies rely on small teams of individuals lacking the collective skills necessary to respond to any and all knowledge requests. Forward-thinking companies that decide to make a proactive investment in specialized skills find these resources difficult to source as the number of graduates with math, science, statistics and other quantitative degrees continues to decline in the U.S. These resources are also expensive to engage, to the tune of more than USD 77,000 annually for a U.S.-based statistician with 5 to 9 years of experience, and USD 56,000 per year for an analyst with less experience. And given their short supply, these experts are only willing to work for top-tier companies which already have an embedded analytics culture.

Scale Challenges

When companies create and consume knowledge in an ad hoc or department-by-department fashion, effective scale can be extremely difficult to achieve as analytic capabilities tend to be closely allied to certain geographies, departments or even specific analytic tasks. And because the resources' loyalties tend to be aligned to their managers, their capabilities are often hidden from the rest of the organization which disables full leverage of these capabilities across the enterprise. Further, companies that rely on individual contributors, rather than organized teams, to generate knowledge often find it challenging to quickly and effectively ramp up knowledge creation to service a business challenge or opportunity.

Organizational Challenges

While many knowledge processes require collaboration across corporate departments to achieve optimal results, these departments are usually at uneven stages of research and analytics capabilities development. Moreover, leadership frequently has various, and often conflicting, objectives and aspirations. These factors make the requisite collaboration extremely challenging, resulting in analytic tasks being driven by the lowest common factor rather than the highest common multiple. Forecasting is a classic example of this challenge. How much a company will sell of a new product depends on many factors including market supply and demand, past performance of the company's products in launch situations, the degree to which the product meets consumers' needs, overall brand perception, the pricing strategy, the competitive environment and the sales and marketing strategies. Thus, input into the forecasting process must come from conceivably every function within the organization. Yet the silo effect in most organizations renders this a near impossible task.

It is fair to say that delivery and management of knowledge processes are typically not an organization's core competency. Thus, when other seemingly more pressing business issues surface, any progress or investment in further knowledge centricity goes by the wayside.

Standardization Challenges

Given that knowledge processes are generally developed and used in pockets by transient resources without deep specialties, the processes themselves typically lack standardization across product divisions, geographies or business units. As a result, analytic processes with the same objective are run with inconsistent data definitions. For example, analytics that manipulate price information from a company's transaction systems can create vastly different outputs depending on the definition of price. Spreadsheets built by individuals across business units or geographies may use different modeling or statistical techniques, or assumptions on consumer metrics. As long as these processes are delivered in silos, there is little prospect of standardizing the rules, assumptions and techniques for analytics.

Cultural Challenges

When deemed strategic and implemented correctly, knowledge processes are fully integrated top-to-bottom in every function, every process and every decision throughout the business. But moving to knowledge-driven decision making can be a hard pill for some executives to swallow. Stanford University professors Jeffrey Pfeffer and Robert I. Sutton wrote in the Harvard Business Review that “evidence-based practice (such as knowledge-based decision making) changes power dynamics, replacing formal authority, reputation, and intuition with data.” Knowledge-based decision making is also a great leveler. Pfeffer and Sutton quoted former Netscape CEO James Barksdale as saying, “If the decision is going to be made by the facts, then everyone's facts, as long as they are relevant, are equal. If the decision is going to be made on people's opinions, then mine count for a lot more.” When leading an organization to become a knowledge competitor, every executive must give up some of the seeming prestige that comes with being the one with the talent and experience necessary to make intuition-based decisions in exchange for being the leader of an organization that consistently outperforms its competitors. Asking executives to make that trade-off, and then obtaining buy-in of stakeholders at all levels, is clearly a major hurdle.

Organizations can become knowledge centric in three ways: by reengineering their internal knowledge processes and organization; by developing the right methodologies and controls to leverage the talents of select third-party resources to augment internal processes; or by outsourcing processes end-to-end to third-party knowledge process outsourcing (KPO) providers. As organizations increasingly realize the critical importance of competing with knowledge, and the capabilities of KPO providers mature and strengthen, more and more organizations are embracing outsourcing as a means to overcome the above challenges and become true knowledge competitors.