For shoppers at the Westfield mall in London, U.K., the shopping experience begins at home. The Westfield app allows them to search for specific products and locate the stores that have them in stock. At the mall, the app helps them find, pay for and tag their parking space. They also receive notifications for the day's best deals at the mall, helping them make the most of their time at the sprawling property.1

U.S.-based specialty retailer, The Container Store, has digitized the in-store experience at its flagship retail outlet in Dallas to enable personalized exploration of its vast range of offerings. Customers can upload a photo or video of their storage challenges and set up an appointment with an Organization Expert before visiting the store. Interactive screens, customized recommendations and more offline customer interactions are allowing the company to blend online and physical experiences for enhanced customer service.2

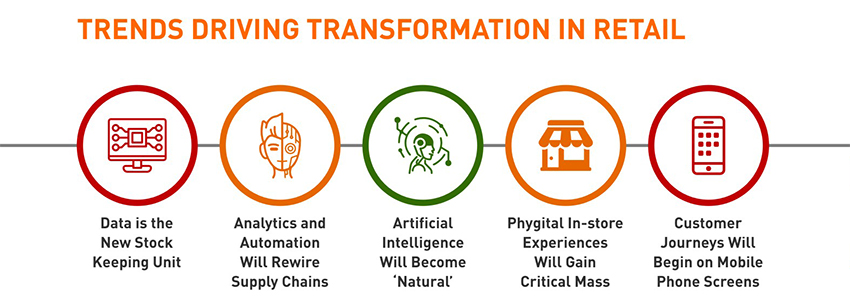

These examples illustrate the integration of physical and digital retail, aptly termed 'phygital' by industry insiders, and the shift toward digitization initiatives backed by technology. We capture some of the trends in retail to understand how companies are achieving this shift.

Trend 1: Data is the New Stock Keeping Unit

Trend 1: Data is the New Stock Keeping Unit

As data continues to drive everything from customer acquisition and loyalty to personalization, platform solutions and the use of application program interfaces for data integration are gaining ground. In the Westfield mall example, the app-led integration is digital infrastructure sitting on top of the physical, with critical continuous inputs from the retail stores within the property enabling the delivery of an integrated customer experience.

Retail companies are also getting smarter about how they manage the data-to-insights value chain, and are moving away from expensive data research and consultancy models. Newer models are emerging where analytics centers of excellence are helping companies in day-to-day decisions such as pricing and strategic ones such as entering new markets.

Trend 2: Analytics and Automation Will Rewire Supply Chains

Trend 2: Analytics and Automation Will Rewire Supply Chains

Automation continues to drive bulk of the supply chain initiatives in a bid to enable faster fulfillment models at manageable costs. However, as automation systems increase in inventory management, picking, order management and sorting, retailers are looking at integrated platforms that can offer consolidated management across all functions. The recently launched MomentumTM Warehouse Execution System from Honeywell Intelligrated is one such unified platform that merges management of distribution centers across automated equipment, workflows, orders and labor.3

This integration is also paving the way for greater application of advanced analytics and machine learning capabilities in the warehouse. As data on exception management across warehouse functions increases, machine learning solutions will be able to 'learn' such exception handling behavior to devise new business rules and drive automation beyond simple tasks.

Radio Frequency Identification (RFID)-led real-time visibility at Stock Keeping Unit (SKU) level is another ongoing area of transformation, with retailers trying to consolidate supply chain and point of sale data via dashboards to monitor daily service level, availability and sales. This consolidation, supported by advanced analytics, is also enabling the definition of more efficient reverse supply chains.

Trend 3: Artificial Intelligence Will Become 'Natural'

Trend 3: Artificial Intelligence Will Become 'Natural'

Cumulative data insights and advanced analytics algorithms are now making intelligent automation of front office functions such as merchandizing and marketing possible. Amazon has been moving tasks such as demand forecasting, inventory ordering and pricing to its algorithms. The company recently announced the complete automation of the negotiation process through which brands price, market and sell their products in the marketplace.4

Chinese e-commerce operator JD.com is using an Artificial Intelligence (AI)-powered writing bot 'Li Bai' to automate the development of over 1000 pieces of product description content daily for its mobile app. Using natural language processing and generation capabilities, the bot trawls through thousands of user reviews and questions to gain insights into how customers describe the product and uses similar language to describe and highlight the right features of its products.5

Real-time data generated from in-store technologies such as RFID tags, computer vision and geo-locations is being analyzed to derive insights on user behavior, preferences and product affinities. These insights are used to drive automation in areas such as store layout related decisions. For example, the use of beacons for automated, location-based, personalized marketing is driven by data from customer visits to specific sections of the store, or items looked for but not found on previous visits.

Trend 4: Phygital In-store Experiences Will Gain Critical Mass

Trend 4: Phygital In-store Experiences Will Gain Critical Mass

Even as digital commerce continues its unabated rise, stores have proven their place as unrivaled stages for immersive brand experiences. They offer the greatest scope for gathering data on customer behavior as well as for cross-selling, and play an important role in most of the fulfillment strategies in use today.

Many retailers are focusing on these strengths and using them in conjunction with digital technologies to open smaller, brand experience or pop-up stores. These stores stock limited, curated assortments, but allow customers to experience the entire range through Augmented Reality (AR) 'smart mirrors,' Virtual Reality (VR), digital catalogs and styling apps, as well as place orders to be delivered at home.

The fashion specialty retailer Nordstrom's no-inventory store format Nordstrom Local allows customers to try out clothes, consult personal stylists, have their clothes altered in-store and refresh themselves at a bar. The store supports fulfillment options such as home delivery, Buy Online Pickup in Store and curbside delivery.6

Across all stores, greater focus is being placed on enabling a friction-free shopping experience through self-service and digital payment options. Recent research has revealed that customers already expect their stores to deliver a tech-enabled experience, with the following must-haves:7

-

Functional, seamless digital payment options

-

Updated online inventory for browsing ahead of store visits

-

Self-checkout options

-

Online ordering capabilities, for pickup in store

-

Online ordering with same-day or one-day home delivery

-

Mobile ordering options / capability

Stores are also experimenting with robots who can welcome, interact, fetch products, address queries or complaints, and process payments to deliver an enhanced customer experience.8

Trend 5: Customer Journeys Will Begin on Mobile Phone Screens

Trend 5: Customer Journeys Will Begin on Mobile Phone Screens

Mobile devices are the primary drivers of e-commerce today, with a Deloitte report finding that mobile orders have grown by 45 percent in Q3 2017 compared to Q3 2016. Mobile traffic to e-commerce sites now outpaces desktop traffic, with 60 percent of traffic coming from mobile versus 33 percent from computers.9 Mobile, therefore, is no longer important as a channel in itself, but is increasingly proving to be the starting point of several customer journeys that may end in a different channel altogether.

Retailers understand this and are looking at integrating mobile into other channel experiences as well. As a result, mobile apps are now being used for pre-visit inventory browsing, ordering and even payments to reduce customer waiting time in-store. As seen in The Container Store example earlier, mobile apps are being used to enable more personalized customer service in stores.

Retailers are also incorporating AR and VR technology in their mobile apps to integrate the in-store and online experiences. Furniture retailer Ikea has teamed up with Apple to launch the Ikea Place app that allows customers to use AR to scan an empty area in their house, browse through recommended furniture, and visualize it in that space to see if it actually works.10

Home improvement retailer Lowe's uses AR in its in-store navigation app to create a map of the store. It allows customers to feed their shopping list on the app, and then guides them around the store to their desired items for a faster and easier experience.11

As the digital transformation of the retail industry achieves greater maturity, future technology will continue to focus on leveraging data to drive further automation, integration and seamless intelligence across functions, channels and players.

Retail companies will also start thinking more like technology companies, with an agile, 'fail-fast' attitude toward technology initiatives. This will help them open up to more changes, in smaller installments, and adopt a culture of ongoing innovation toward creating the ultimate customer experience.