The travel industry is among the top five sectors that has embraced significant changes brought about by digital disruption. From the planning stage to ticket booking to the journey experience and sharing those experiences on social media, digital technologies play a pivotal role in the travel sector. Artificial Intelligence (AI), machine-learning, deep learning, Internet of things (IoT), Augmented Reality (AR), Virtual Reality (VR), drones, robotics, 3D printing, bitcoin and advanced data analytics have all marched their way into this industry.

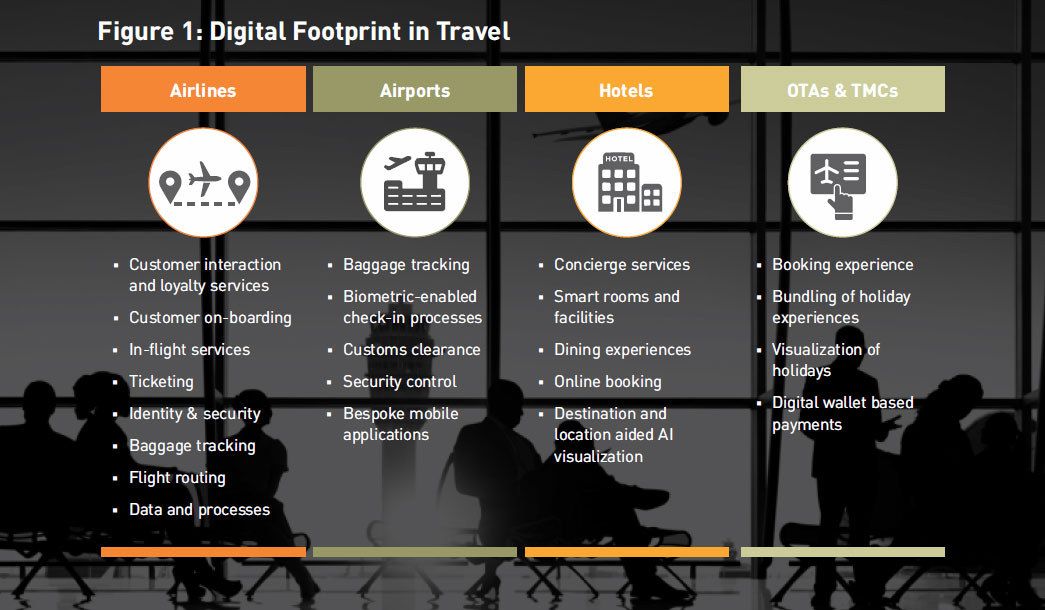

As shown in Figure 1, all players of the travel ecosystem — airlines, airports, hotels, Online Travel Agencies (OTAs) and Travel Management Companies (TMCs) — are leveraging digital technologies in some form for various operations.

Here are some examples of the digital innovations that travel players have deployed in recent times:

In conclusion, NBP holds the key to enhanced customer engagement and maximizing revenues for the banking industry in an intensely competitive and disruptive environment.

-

Lufthansa has introduced Avegant Glyph headsets, the AI chatbot 'Mildred' and 200 Bluetooth beacons at Munich Airport. Scandinavian Airlines has customer touch interfaces, app-managed electronic bag tags and chatbots

-

San Jose International Airport has partnered with Google Tango to try AR technology for wayfinding, airport retail promotions and billboards to display destination information

-

Japan's five-star hotel Henn-na is the first to be equipped with intelligent robots and 90 percent of the hotel's staff are robots

-

Zanadu and Thomas Cook's joint VR promotion of New York excursions has given a boost to their revenues by 190-200 percent

But do all these innovations mean that the industry is ready for a digital future? Let's pause and look at the readiness of different service providers for the next wave of digitalization.

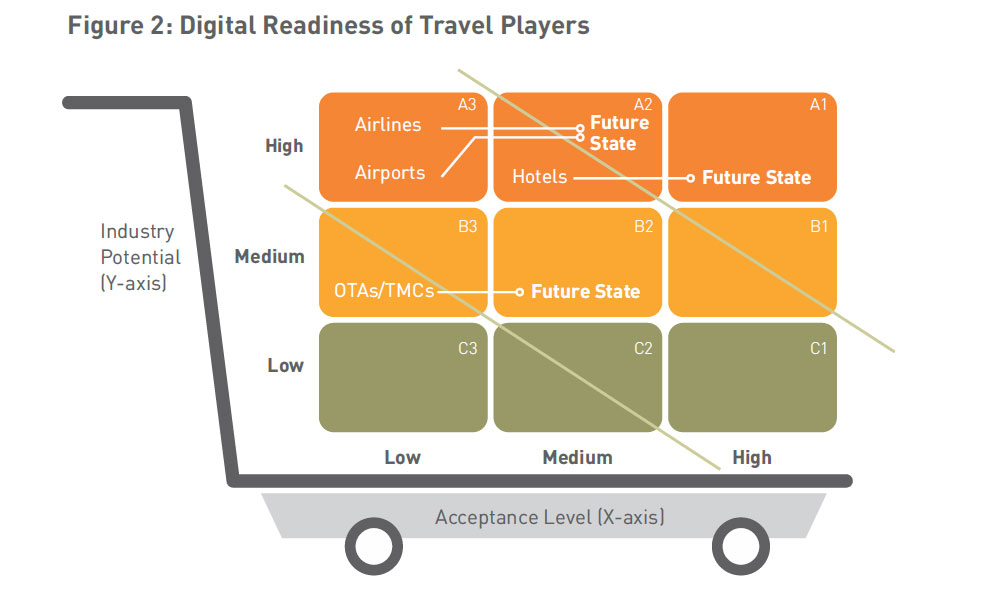

In Figure 2, we have mapped the current levels of digital readiness and the desired future state of each player. The industry's potential for digitalization is plotted on the Y-axis and the acceptance level is plotted on the X-axis. The levels are classified as high, medium and low on both axes.

Airlines and airports are at present in quadrant A3 as they have high potential and low acceptance levels. The next ideal step for them is to move to quadrant A2. Hotels, already in quadrant A2 with high potential and medium acceptance levels, should move to quadrant A1 which represents the desired future state. OTAs / TMCs with medium potential and low acceptance levels should move from quadrant B3 to B2, their ideal future state.

The current state of all these players has been created based on data gleaned from airlines, airports, hotels, OTAs and TMCs for a period of one year. This data was collected from various sources including initiatives already executed, planned investments, CXO conversations and media mentions covering approximately top 50 percent of the market players. With the adoption of next-generation technology, there's a likelihood that all players will move to quadrants A2, A1 and B1 respectively in the next two years.

The hotel industry is at present ahead of the other players based on its level of consumer engagement. OTAs and TMCs are next in line as they aim to bring customers quickly into the e-commerce age compared to airports and airlines. The next one year will be interesting to watch as the clamor for autonomous, driverless, AI and Near Field Communication (NFC)-based technologies gain momentum.

"What Lies Ahead?

"What Lies Ahead?

Digitalization is an almost irreversible trend and the future should be viewed as an exciting goldmine of opportunities. According to the World Economic Forum, digitalization in the next decade has the potential to unlock about USD 1 Trillion of value for the industry. Connectivity, analytics, automation, AI and hyper personalization will boost productivity, and shared economy models will create both efficiencies and economic benefits.

The next surge of travel digitalization and IoT-based transformation has already begun. On the technology front, legacy systems are transforming into agile interoperable platforms. Many organizations are looking to reskill their workforce to meet the demands of the digital economy.

For example, Ryanair, in addition to its mobile app MyRyanair, has established innovation labs and the company's new website is embedded with digital technology. The airline industry is pursuing blockchain in ticketing applications, operations and identity management. The newest terminal at Singapore's Changi Airport will be equipped with biometrics, embedded chips and vascular technology systems. The Marriott chain of hotels is all set to launch real-time app messaging (mPlaces), 4D VR travel experiences and VR postcards.

However, the complete value of digitalization can be experienced only if multiple participants in the travel ecosystem take concerted and shared actions. This calls for identifying the right strategic intent of clients, scaling up capabilities and partnering with relevant stakeholders to provide service offerings in an integrated manner. This will combine the benefits of business and technology, and provide seamless and frictionless travel experiences to customers in a 'digital' world.