Executive Summary

The international shipping industry is a vital cog that keeps the wheels of the global economy moving, making up for almost 90 percent of global trade by volume. The economic storm of 2008-09 lashed at the industry so hard that even years later, growth rates are still far from recovery.

Shipping companies are constantly challenging themselves with newer business strategies in an effort to survive, and even grow, despite the harsh macro-economic environs. While some have adopted partnering with Business Process Management (BPM) service providers as an efficient way of ensuring business growth, some others have still not found comfort in handing over a part of their operations to a partner. They have, instead, adopted another business strategy of consolidating operations into captive Shared Service Centers (SSC).

This point of view helps analyze how shipping companies can realize business benefits by setting up SSCs, and further derive increased business value even after the SSC matures. The point of view also contains a caselet on how a leading shipping and logistics player benefited when WNS re-badged its SSC.

Introduction

Oceans have been the most popular, and the only means of international transportation until a few decades ago. Things have changed over the years … ships now carry goods rather than people, and sea travel has become more of a recreational activity. The economic meltdown resulted in a massive dip in world trade, and consequently, maritime trade. It impacted the industry’s three main segments: tanker, dry bulk and container. The industry grew 4 percent in 2011, and since then, it has witnessed a very slow rebound. Despite these constraints, the international shipping industry still makes up around 90 percent of global trade by volume, and connects large sectors of the global economy.

Two broad factors are influencing the shipping industry:

Oversupply

In the global shipping industry, supply far exceeds demand. Shipping rates have nosedived, as have the prices of ships. The turnaround in demand in the shipping industry depends on global economic recovery, which itself is slower than anticipated. Several other macro-economic factors could prevent the industry from witnessing corrections, such as volatility in oil and steel

prices. Some shipping companies have sought to buck the trend by investing in newer, larger ships at lower prices. But unless demand rebounds, the industry’s problem of oversupply is likely to only worsen.

Purchase of Larger Ships

The demand for larger ships has been fuelled by two primary factors – operating costs and environmental concerns. After rates for container shipping collapsed in the wake of the global recession in 2008-09, orders to the shipbuilding industry were cancelled in bulk.

However, larger ships are turning out to be a boon for shippers and for the global environment. These ships consume half the fuel per container as compared to older and smaller ships, while carrying three times the cargo. Plus, insurance and staffing costs are also half. A megaship requires the same 20-odd crew as a smaller ship! However, as the mega ships add excess capacity, it is snowballing into a reduction in freight rates, thus impacting the profitability of shipping companies.

The Way Ahead

For many shipping companies, this period of uncertainty and flux presents itself as an opportunity to re-align business strategies with shifting paradigms. With a turnaround in business unclear on the horizon, the need-of-the-hour is to keep costs under control, increase process efficiencies, re-structure operating models and offer superior customer service. Many of them are turning to offshore Business Process Management (BPM) service providers to leverage cost efficiencies, world-class processes and abundant resource pools.

But not all companies are comfortable in handing over their back-office operations to a third-party. These organizations are choosing to consolidate operations into captive Shared Service Centers (SSC), or Global In-house Centers (GIC).

Tackling the Challenge of Complexity

One of the biggest challenges while implementing a global SSC is complexity – organizational, functional and political. Complexity, therefore, increases the risk of failure. To mitigate risk, companies rope in a trusted partner to guide them through the maze of decisions involved in consolidating back-office functions such as documentation, operations, finance, HR, procurement and analytics. Support in the form of an experienced partner can help hasten business benefits and growth.

Shipping companies, who consider captive shared service centers as a viable option, can work with experienced BPM service providers to set up one. Large BPM players have usually implemented dozens of delivery centers across the world for multiple clients and successfully transitioned hundreds of complex processes. Shipping companies can leverage this experience in a number of ways, depending on their appetite to engage, and minimize the risk of failure.

The Lifecycle of a Captive Shared Services Center

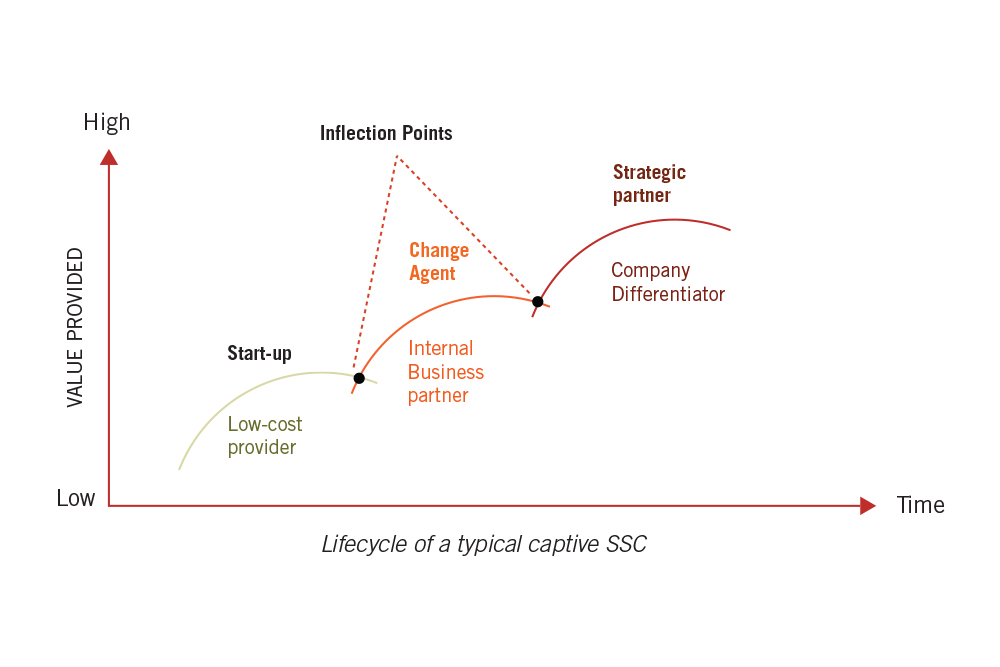

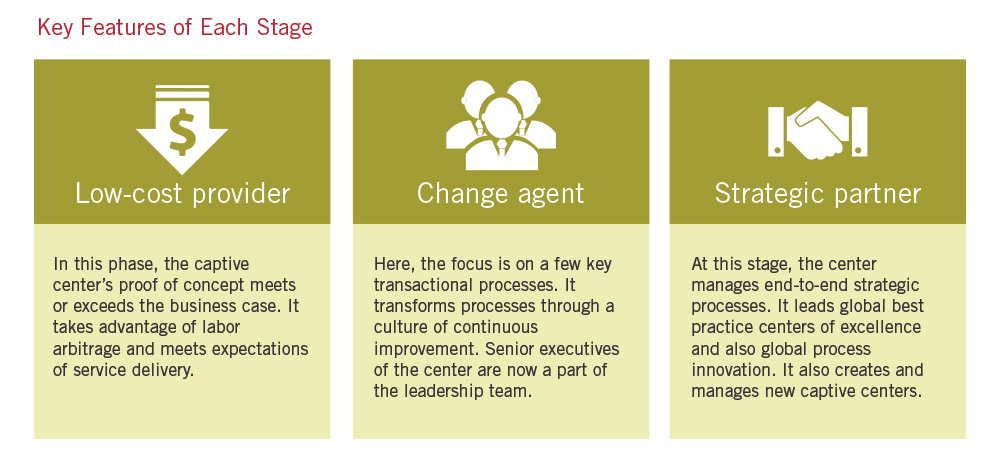

Once a captive center has been established, it may go through several phases, from low-cost provider to change agent and eventually to a strategic partner.

At each inflection point, the questions that need to be taken into consideration are:

- Has the center achieved most of the labor arbitrage available for the specific location(s)?

- How should turnover and competition for top talent bedealt with?

- How can the facility, systems and talent be upgraded?

- How can the company get more value from the captivecenter?

Key decisions that have to be made:

- What is the operating model that will give the company the next generation of savings?

- Should the company expand, move, or sell the center?

- What is the investment needed to move to the next level?

- What is the realistic ROI?

- What other investments are competing for funds, talentand management mindshare?

Setting up a Captive Shared Service Center

Business Process Management (BPM) service providers bring to the table their depth of experience that comes from having implemented dozens of deliv

This depth of experience can be leveraged in four broad ways to establish a captive SSC. Depending on the shipping company’s appetite to engage, it can choose one of the four models.

The key features of these four models are given below:

Challenges that Shipping Companies can Face with Moving Up the Value Chain

Operating Costs

Unlike BPM companies, where there are multiple clients being serviced, captive centers have only client – the shipping company itself! With the result, the center must spread its current / future infrastructure and upgrade costs only for that one entity. This is unlike a typical outsourcing engagement, in which the BPM partner leverages its infrastructure across many clients. Besides, the captive center may have to restrict itself only to one location, again in contrast to BPM companies that can choose to operate out of different locations in order to leverage talent and costs.

Scale

Captive centers would find it rather hard to benefit from economies-of-scale unless they can have a critical mass of 1000+ Full-time Equivalent (FTE) employees in range.

Transformation Capabilities

A captive center would find expanding services beyond its initial scope challenging. It would also not invest as regularly as a BPM provider. The center will find it difficult to expand services beyond its initial scope, and may not have strong research and analytical abilities. A captive center simply does not have the experience gained through engagements with a variety of customers and processes. Besides, most companies will be unwilling to invest in developing that capability.

Moving Up the Value Chain

The decision to set up and run a captive SSC can sometimes seem far easier than getting it to move up the value chain as the centers may face several challenges, including high operating costs, lack of ability to scale and taking the right steps towards business transformation.

To enable the captive center to scale up the value chain, a shipping company can consider implementing any of the three most popular operating models:

- Asset Sale and Re-badging

- Captive Carve-out and Sale

- Monetization of the Center

Asset Sale and Re-badging

In this model, the BPM provider takes over the existing assets (IT and infrastructure) from a shipping company and `re-badges’ all employees responsible for service delivery. The company signs a contract with the provider for service delivery.

An integrated multi-level governance model smoothens the transition, with an emphasis on risk identification and mitigation. Tools and technologies are deployed to automate manual tasks and eliminate errors. For example, implementing an intelligent Optical Character Recognition tool can help eliminate manual data entry of shipping instructions.

The BPM provider then creates a customized metric management framework for operations. Transactional pricing starts from day one of operations, leading to instant variabilization of operational costs. Key Performance Indicators (KPI) around customer services are set after being benchmarked to best-in-class with a defined program to improve performance.

Captive Carve-out and Sale

In this model, captive operations such as assets and employees are converted into a separate legal entity. The BPM service provider takes over the entire captive center and pays for the value of the assets. The shipping company then signs a contract with the BPM provider for service delivery.

Monetization of the Shared Services Center

This model involves turning captive operations into a separate legal entity, with the BPM service provider taking over a majority stake and paying the shipping company the value of the center’s assets. The company then signs a contract with the BPM provider for service delivery.

However, in this case, the BPM provider can also use the captive center to accept engagements from other clients. The profits from the entire operations (work done for the shipping company plus other clients) are then shared with the shipping company in proportion to its equity holding.

Both the service provider and the shipping company can buy out the other’s stake and take over the captive center through an agreed valuation process and formula.

A Case in Point

A top global ocean carrier re-badges its captive center in East Asia to WNS

A global container shipping line was experiencing high costs and inefficiency within its captive operation located in an East Asian country. WNS re-badged all of the client’s employees and took over the operations, offering a unit transaction pricing (UTP) model from day one. This process led to instant variabilization of costs and improvement in productivity through robust

metrics management and reporting structure.

Conclusion

With recovery a fair distance away, shipping companies can effectively contain costs, improve process efficiencies and offer effective customer service to protect future revenues.

Setting up a captive SSC can be an effective strategy in achieving these elusive goals. The risks in setting up such a center can be mitigated by leveraging the deep domain experience of a Business Process Management (BPM) provider to assist with the establishment and operationalization of the captive center. Even after the capacity of the center matures over time, the shipping company can still derive business value by monetizing, re-badging or hiving off the center.